For the last four years, the idea of “forgiving” student loans has been a juicy morsel dangled by Biden’s puppet masters to try to entice young adults to show up to vote for Democrats. It has been mostly thwarted on a number of occasions by the courts as you can’t just make hundreds of billions of dollars disappear. It didn’t really appear to move the needle for Biden and I don’t really recall Cumala bringing it up, although I tried to avoid listening to her drunken rants.

That didn’t stop the people animating Biden’s corpse with the blood of infants from trying to sneak more “forgiveness” in before they wheel him out of the White House.

President Biden makes his final student loan “cancelation”: $4.5 billion for 261,000 borrowers

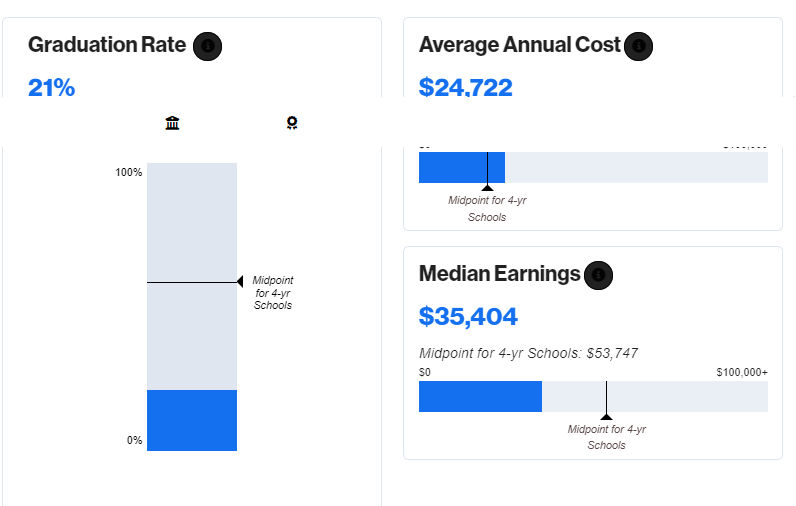

This only impacts those who attended “Ashford University”, an online school that has changed names a bunch of times and is now called “University of Arizona Global Campus“. The move to the University of Arizona was not without controversy as “Ashford University” was a for-profit school, which I am OK with, but was also clearly a scam. No shocker, almost 1/3 of the “students” at “Ashford University” are black while the main University of Arizona is only 4% black (likely a large percentage of those are athletes on scholarship). “Ashford University” boasts an abysmal “8-year graduation rate”:

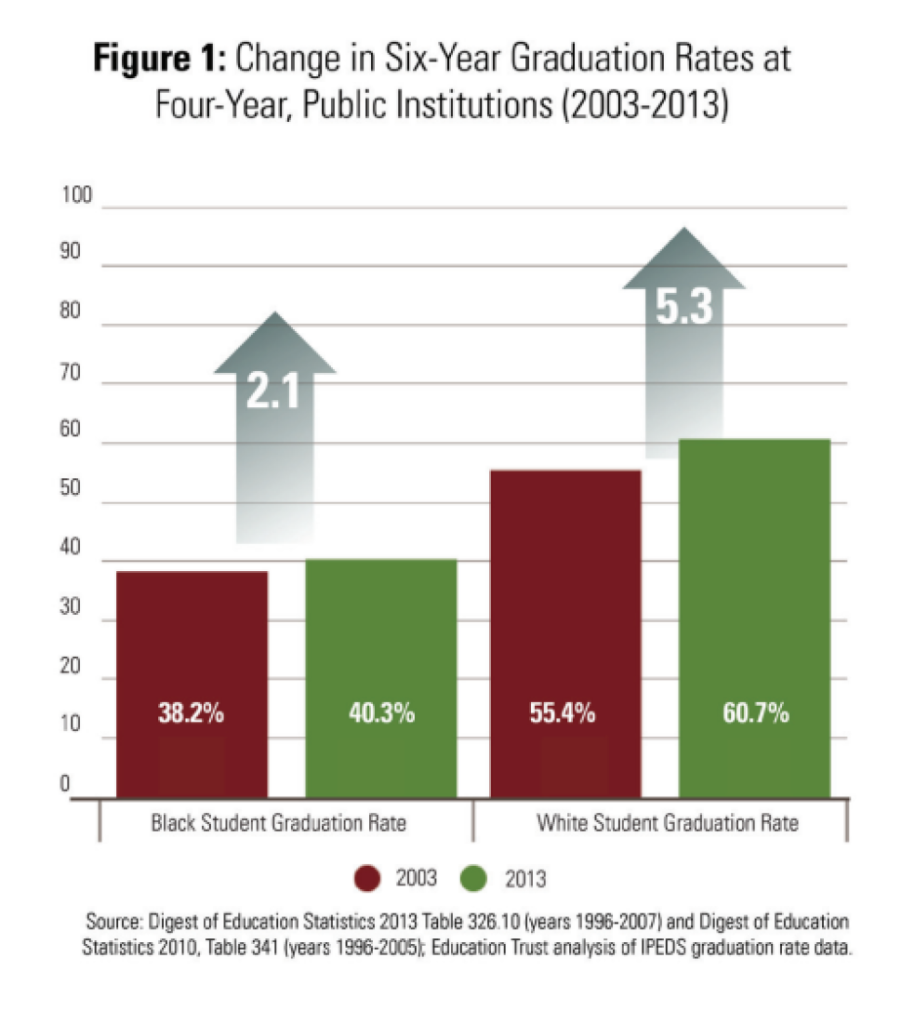

When you are graduating one in five students over an 8 year period, that is not great, meaning that a lot of people are attending this “school” online, taking out loans to pay for them, and then not even graduating. It’s bad enough trying to find a job that will allow you to pay back your student loans if you graduate but without the piece of paper? It becomes a lot harder. This isn’t really shocking when you consider that “Ashford University” has a student body that is 1/3 black. In a 2018 post, Participation Ribbon Egalitarianism Has No Place In Education, I looked at the 6-year graduation rates for blacks in four-year degree programs. To the surprise of absolutely no one, it isn’t great:

Even the White graduation rate isn’t swell, 2 in 5 Whites that attend college never graduate. Something I wrote in the above post is one of the main posts of today’s post:

We send too many kids to college and a significant percentage of them have no business pursuing a four year degree.

Paraphrasing another quote from the 2018 post, college has turned into an extension of high school and a way to prolong adolescence and delay adulthood.

What most people don’t seem to realize: places like “Ashford University” exist because of the student loan system and the generally awful graduation rates and general outcomes for those who enroll in a 4 year college are likewise directly tied to a system where the entire mechanism is based on a perversion of sensible lending practices.

Knowing that is one thing but the fact remains that there is an enormous problem with student loan debt in America.

Student loan debt: Averages and other statistics in 2025

The numbers are pretty grim.

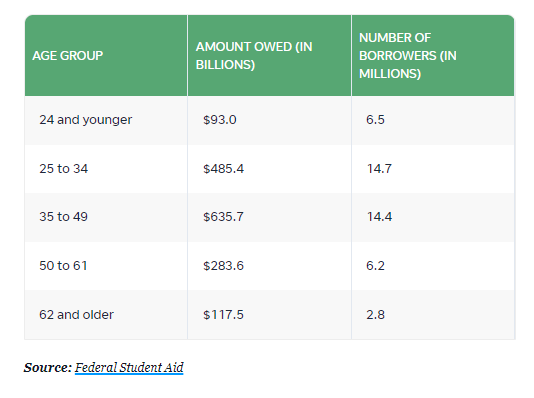

The cost of college has more than doubled over the past four decades — and student loan borrowing has risen along with it. The student loan debt balance in the U.S. has increased by 66% over the past decade, and it now totals more than $1.74 trillion, according to the Federal Reserve.

That number is charging toward $2 trillion pretty quickly and the simple fact of the matter is that most people simply will never pay off those loans. We can point fingers and blame people, and ultimately it is your responsibility if you take out a loan to pay back that loan as agreed. It doesn’t change the fact that tens of millions of Americans are carrying a significant loan that makes the already untenable cost of living just that much higher. Young people are coming out of college, many with useless degrees, into a world where they can barely afford a crappy apartment. When you add student loans on top of that, it is little wonder that so many loans are delinquent and in default.

With the above caveat in place, the message high school graduates have heard ad nauseum is that without a college degree you will never make it in America. Set aside that it isn’t true, it is what these kids have heard from the TV, from social media, from teachers and counselors at school and of course from family. It started to really pick up when I was in school and back then a lot of kids didn’t go to college but it was already heating up: there aren’t multiple paths to being middle-class, there is only one and that is a four-year degree.

The message wasn’t “get a degree in something with real world applications and you will get a job”, rather it was just “get a degree and that is your ticket to the middle class”. At the same time there was a general disparagement of jobs where you might get dirty even though a significant percentage of high school graduates would have been far better off financially if they eschewed college and learned a trade.

Again, setting aside the blame game, the situation is that we have a major problem that impacts young adults in America and not only that but it is especially a problem for America’s problem children: blacks….

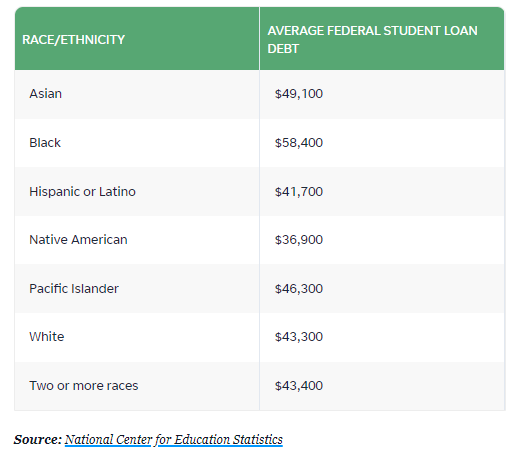

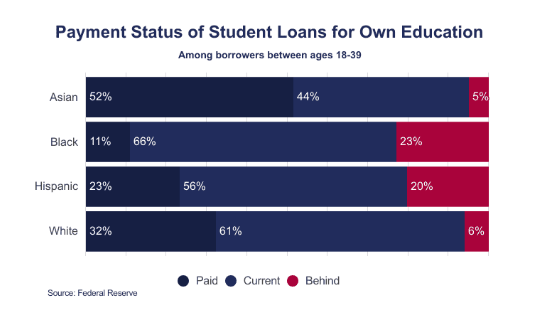

This is from the post linked above and looks at debt levels four years after completing a four year degree, meaning it doesn’t even take into account those who started college and didn’t finish which is upwards of 60% for blacks. I would be remiss if I didn’t point out that it is not coincidental that blacks have a much higher average debt level, nearly $15,000 higher than Whites despite blacks being far more likely to get race and need based scholarships than Whites. Student loans can be used not just for directly paying tuition but also for living expenses, meaning that the system gives 18-22 year old kids with no credit and usually without jobs access to what appears to be “free money”. Add in a lack of impulse control and high time preference? That is how you end up with a $15,000 gap. Student loans were not intended to pay for bottles of Hennessy and spinner rims. In a shocking twist, blacks also are far less likely to have paid off their loans and far more likely to be delinquent, around four times as likely to be delinquent as White borrowers:

The point is that we have a serious problem with student loan debt and no easy way to deal with it without stepping on the toes of one or another powerful interest group. It isn’t a coincidence that the Senator from Delaware, home to a ton of lenders, also was instrumental in makin it harder to discharge student loan debt in bankruptcy, the same guy who as “President” wanted to “forgive” those very same student loans: Biden made it harder for student-loan borrowers to get rid of debt when they go bankrupt

Student loans are a perfect example of something that sounded good on paper but was a disaster in reality. The fundamental problem is that they operate in a way that no other loans do by removing any sort of underwriting. If you want to borrow $80,000 to buy a new F-350 pick ’em up truck, the dealership will run your credit to see if you have been responsible with credit in the past, specifically by looking at your history as a borrower and if you “paid as agreed” your current and previous loans. They will look at your debt-to-income level, do you have sufficient income to service this new debt? If the new payment will push your monthly debt servicing level over a certain percentage of your total income, you won’t get approved or if you do it will be at a much higher interest rate, to reflect the higher risk of lending you the money.

On the other hand, if you want to borrow $80,000 to finance a degree in Medieval African Lesbian Film Studies? You have to do a little online course about your obligation to pay back your loans that you promptly ignore and then they give you the money. There is no underwriting, no credit check, no question of how you will repay the loan. The reason is that most of these loans are backed up by Uncle Sam.

The reason a bank won’t loan you $750,000 to buy a house if you have poor credit and only make $32,000 per year is that the bank doesn’t want to foreclose on your home, it wants you to pay back the loan. The traditional way banks make money is to offer interest on deposits and then lending those deposits out at a higher rate of interest in the form of mortgages, car loans, etc. The spread between what they pay on deposits and what they charge on loans is where they made money. A big part of the process is assessing risk because as I said, they don’t want your house. If you have ample income and a solid history of paying back loans, you will be more likely to be approved at a more favorable rate. The less income and the poorer your history, the less likely you will get a favorable rate and the less likely you are to be approved.

Student loans take a lot of the risk out of the equation. Therein lies the problem.

So what is my “modest proposal” on student loans? Given that the system is untenable as it is, my proposal would be to do a hard reset on student loans but splitting up the pain three ways: the Federal government, the lenders and the universities. The end result would be zeroing out all student loans but making the beneficiaries of the system, lenders and especially universities, pay for 2/3 of the cost.

“Well that isn’t fair! I don’t have student loans!” or “That isn’t fair, I paid my loans off!”. You are correct, it isn’t fair. It’s a dump truck load of steaming bullshit. The problem was created decades ago and it is kneecapping entire generations of young adults and it is also a problem even for older Americans…

Millions of Boomers in or approaching “retirement” still have student loans. If things don’t change, that is only going to grow worse as millions of people add student loan debt every year with no reasonable means of ever paying them off. Americans will soon be spending their entire working lives trying to pay back student loans, making it harder to buy a home or start a family.

The biggest beneficiary of this has been the college and university system in America that has been jacking up tuition costs for decades because their customer base has been told that getting a degree is the only way to get ahead in America and thanks to student loans almost anyone who can fog a mirror can get a student loan to pay for college. At a minimum, those colleges that can afford to pay diversity, equity and inclusion offices with more than 100 full time staff should have to foot a big chunk of the bill to wipe out student loans. Those loans provide a firehose of money flowing to colleges and because of that these schools can raise tuition every year and still sell their product because there is an unlimited amount of money to fund college tuition.

But forcing colleges and universities to absorb more than half a trillion in loan forgiveness will cause many of them to go under and the ones that survive will have to slash administrative staff and course offerings!

Exactly.

The government pisses away half a trillion without blinking anyway so that isn”t a problem and as for the lenders?

I have something special in mind for them.

The only way this proposal would work is if at the end of the day the student loan system is completely dismantled at the Federal level.

No more subsidized or unsubsidized loans. The Federal government would not back up these loans meaning that if the lender had a loan default, the lender would have to eat it, not the taxpayers.

The impact would be immediate.

Lenders would still lend money to college students but there would be a much different process, one more like what we see in traditional automotive and mortgage lending. If you want a loan for college, you would have to show how the degree you are pursuing would lead to you paying back the loan. If you are looking for a professional degree, like accounting or actuarial science, mechanical engineering or nursing? You would probably be able to get a loan as those degrees typically lead directly to employment. Going to medical school? On acceptance you would be able to borrow quite a lot as you really can’t work a job and go to medical school so you would need both tuition and living expenses, but on graduation you would be looking at a very high paying professional career. If you want a loan for college, you fill out an application and explain to a loan officer how you will pay it back. If you can’t explain how, you don’t get the loan.

On the other hand if you want to study about Alaskan Transgender Auto Mechanics? Go to the library and get a book because you aren’t getting a loan for that.

This would absolutely cause many colleges to close and they should. It would also force colleges to radically lower tuition if they want to offer liberal arts degrees or other degrees that don’t have a reasonable expectation of a salary that would repay the loan.

In short, the only way to fix the student loan debt crisis is to eliminate the source of the crisis: the student loan system itself.

Honestly most colleges and universities don’t even need to exist and most people who attend college don’t need to be because most degrees have very little use in the real world. I have a degree with a major in Political Science and a minor in history but I have learned far more about both of those topics on my own long after college. Getting rid of most colleges will dramatically shrink the pool of college graduates which will in turn destroy much of the empty credentialism that dominates most corporate hiring. In my corporate career I was a bank manager, a relationship manager in financial services, a retail manager. Not one of those jobs was something I needed a degree to accomplish and nothing I learned in college was of the slightest use in those jobs. I’ve said it before, I learned far more useful skills in four years in the FFA in high school than I did in four years of college.

In summary:

- Wipe out existing college debt

- Spread the losses more or less evenly between colleges and universities, student loan lenders and the Federal government

- Eliminate the government student loan system entirely

Of course this won’t happen. There is far too much money at stake and no one has the courage to say these things that is in a position to make it come to life but if this was implemented it would have major positive implications for the entire American society.

The whole system is a form of the Kobayashi Maru, a no-win scenario. The only way to fix it is to change the rules entirely.

A guy named Karl Denninger has a great idea on student loans. Make them dischargable in bankruptcy but if you do that the degree becomes null and void. This does not solve the problem of students with debt who don’t complete college but it be a sobering reminder to students pursuing useless degrees. Also many colleges have huge endowments. Why no go after those?

Just like everything else in the steaming fourth world turd, fake and GAE.

I hammer that because I grew up in the real America and even lived through Brandon part one Jimmeh Carta as a lil’ shaver.

Don’t forget grant surfers who attend just enough to get that college money, Iearned of it from CL seller.

Denninger’s idea is cruel, because kids and often their parents, have been brainwashed about the importance of college…I would discharge all of them, and get the US government completely out of the loan guarantee business…That would result in a 90% decline in student loans, but not cripple kids who didn’t know what they were doing, and let them get on with life….

I disagree. How many kids got into crap like gender studies. What the hell is that? These are primarily future cat ladies that with some luck will end up in HR positions and make life difficult for white males with real skills. Let the buyer be aware.

Within the first paragraph, I was getting ready to rant, but finishing the reading, I’m on the same page.

I am not concerned with the feelings of predatory lenders, nor am I concerned with the feelings of special interest group members who have been given money to have their egos stroked with a degree and a potential 100k do nothing job in corporations or gov’t. Nor am I particularly concerned with the problems of perpetual adolescents who want to party and get laid, rather than looking for a husband or a job. (Yes. That is directly aimed at college feminist sluts!). And I certainly do not want to hear anything from posturing politicians about opportunity.

I don’t care if you borrow money for a degree, a car, a purse, or a drug-fueled, alcohol-soaked bender. Both you and the lender are on the hook. As long as we agree that the loan taker and the loan lender are on the hook, and not the distant, non-involved, third party tax payer, they can do what they like.

All the problems in loans, government, corporations, etc. are all due to the fact that the people responsible for the f-d-up situation are always able to pass the pain on to someone else. When they have to bear the cost, shit changes.

But could I use my student loan for an F350 pickemup truck?

My grandson is seven years post HS graduation, did not attend university and is self-sufficient as a driver for a top tier delivery firm.

Several of his friends went the college route and a few haven’t gotten around to graduating yet; the others are in low-paying jobs unassociated with their “history” and “elementary ed” degrees.

Once my grandson got over his fear that we would think less of him for not having a sheepskin (we worked diligently to assure him that his choices were wise ones) he was pleasantly surprised that he has: a) bought a new truck, b) put down a DP on a condo and c) has zero debt to his name.

All in all, he’s a resounding success in my book.

The real fix for all this bullshit is to:

1) restore true freedom of association (aka the right to discriminate) so that a college degree isn’t used as a proxy for simply filtering out and not hiring dumbshits that companies don’t want on their payrolls, because they are incapable of doing the job. This means no more discrimination lawsuits and other lawfare because you were (fill in the blank race, gender, etc.) and didn’t get the job you wanted. Fuck off and go find something you actually can do.

2) break the back of the universities, and the perception that everyone needs to go to college. The latter is more a social status issue than an academic one, as is obvious to anyone who isn’t bullshitting themselves.

3) eliminate the decadence of the modern university experience. All these fancy accommodations and eateries that rival Las Vegas hotels, instead of concrete block dorms and basic cafeterias, has made the whole thing too costly and unsustainable. The expectation has been created for that experience of course, and now it will have to be destroyed to return to some semblance of reality.

4) get the fucking government out of student loans, everything they touch turns to shit.

5) make student loans dischargeable in bankruptcy again.

6) stop all the immigration that drives down wages and sucks up domestic jobs that American’s would do, if not for eschewing the risk of getting expensive degrees only to get fucked by not being considered for the jobs that require them. All because corporations are whores who will pass them over for a foreigner who will work for so much less.

The above would solve the problem going forward. Those already struggling under student loans debt should be given back the ability to discharge it in bankruptcy, and much of the resulting losses should be charged back on the universities, as they were instrumental in perpetrating this large scale fraud of granting meaningless degrees to those who borrowed heavily to get them.

And if it blows up said universities and forces their closure due to bankruptcy, then good. Fuck ’em. We are already seeing a fair number of smaller uni’s close up shop as they are no longer viable. That trend needs to gather steam. And I’d love to see the ivy’s utterly destroyed, as they are ground zero for all the political and social dysfunction that plagues our society.

And that’s why it will never happen because it would fix a lot of problems…

That’s the whole crux of the matter whatever would fix the problems that ail the White Population will never be done because they hate us and want us dead…It’s up to us if we want to fix them and at this point in time not enough of us do…

I was skeptical at first but by the end, you made a believer out of me. BZ.

I like your plan. Or, make them like any loan – dischargeable by bankruptcy. Then they go away.

I had to take out a student loan my last semester of college. I was in the accelerator program where you do 8 weeks of classes each summer as well as spring/fall semesters with 10hr days. It gets you done a full year early but not much time for jobs and only 5 weeks a year off (4 in august and 1 in December).

At the time the Canadian govt awarded student loans but they had a contract were CIBC actually gave you the money and then collected it back after graduation. If you defaulted they feds paid cibc back.

I graduated and had an entry level job, a clause said cibc could set the interest rate after graduating at an appropriate level. Which they decided was 22%.

I was told by CIBC i should declare bankruptcy as everyone wins, i get out of the loan and they get paid instantly by the feds and get all the lost interest as well. I refused and they got unfriendly even though i was not behind on payments.

I tried a couple other banks to see if i could get a loan to payoff the CIBC one and everyone told me they were not allowed to loan money to pay off a student loan as CIBC had a deal with the feds.

Till I talked to a lender at a credit union, he said they couldn’t loan me money to pay off the student loan but given my job and credit rating they could loan me money for other things and once i had the money i could do whatever i wanted with it. So he got me a 16k loan for a holiday cruise….. As soon as i had the loan i paid of cibc and the new loan was at 5.4%

Not sure if US ones are as corrupt or not. Oh years later cibc was found guilty of illegal loan practices and forced to return the excess interest they had charged. I got a cheque for a couple hundred bucks then.

I was blessed to get my undergrad degree without loans and graduated debt free. A scholarship paid for the first never-completed MA. But I needed help for the second never completed MA – I was working two part-time jobs while going to school while commuting by bus from the foreign diplomat’s home where I had basement housing (in exchange for walking the dog and helping with the kids’ homework) and it was killing me. I ended up applying for and getting a loan, and since I got hired by State the following year (which is why I never finished the degree) I paid on it for a few years and then was able to pay it off when I sold my car before returning to the states 6 years later.

Anyhow – half of all colleges/universities should go under, and the rest need to have their endowments whittled down. Limit college to the top 10-15% of qualified heritage American students and shut the rest down. All the DIE students/profs can learn to code and get turned down for jobs by pajeets.

I would add to your list to make businesses requiring a 4 year degree for jobs that don’t need one and especially if they accept any 4 year degree. An example is Administrative Assistant. No need of a 4 year degree.

Simplest is to just make the banks eat it, they’ll stop. And get some AG to sue the Fed gov for doing something (else) unconstitutional (that being in the loan backstopping business).

Serious question – Do the college attendees in those worthless degree programs KNOW that they are in worthless degree programs? Or are they so brainwashed as to suppose that a degree in the “soft” sciences is actually a ticket to success?

I did my first degree (Chemical Engineering) on a half-ride academic scholarship and my own dime back when state university tuition was still quite reasonable. Then got an entry-level job with a chemical firm which had a generous (fully-paid) tuition refund policy, a common thing back then. The grad school I attended was one that I never would have been able to afford on my own, without incurring crippling debt. But Big Corporation paid for my masters degree in toto and I emerged well-educated and debt-free.

Surely, no profit-seeking enterprise is subsidizing Karen’s post-doctoral education in Menstrual Studies. Doesn’t anyone involved, bank or goobermint, vet an applicant’s future earning potential before forking over $150k in unsecured loans?

Also need to deal with Griggs v. Duke Power Co. so businesses can filter out morons without requiring degrees.