Our wise and benevolent overlords in D.C. are fixing to send out some free money to shore up the economy! Hooray! Initial reports make it sound like we are getting $2400 for my wife and I plus another $2000 for our kids that are home. I know a family with 17 kids, I wonder how much they are going to score?

Where is this magical money coming from?

Wishes, hopes and dreams!

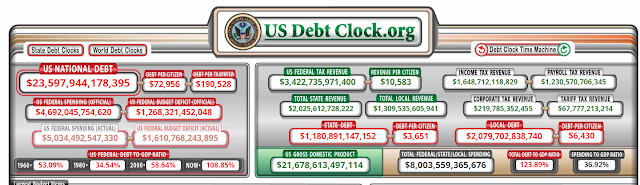

Seriously though, it is going to be “borrowed” money like so much Federal spending. I put the scare quotes up because no one seriously thinks we will ever pay back the national debt, mostly because we can’t and we won’t. This is why…

The critical number is the amount per tax payer: over $190,000. As the Boomers retire and become net takers from the system and are replaced with minority workers who will make less and therefore pay less, and often much less or nothing, in taxes the available revenue to meet Federal expenditures will decrease. Federal outlays are never going to decrease. The budget is already spending about 10% of total outlays just on interest for debt we spent in prior years and since that debt number never goes down and is increasing rapidly, the percentage of the Federal budget used to pay for prior year deficit spending is going to go up. Adding some $2 trillion in new deficit spending on the stimulus means we just increased the national debt by almost 10%. We are never going to pay the debt back so we should just call it something else.

To be clear, I am not even objecting to the stimulus payments. People are being told to stay home but they still have bills. Business are being told to close but we want them to reopen when this crisis passes. If there was ever a time for something like this, it is right now. Having said that, this would be easier to swallow if we lived in a serious country.

If we were a serious country, we wouldn’t have a national debt. At all. We would spend only what we brought in and even better less than we bring in. When something like this happens, we could borrow some money, spread it around and then pay that debt off promptly. But we don’t have a serious country (ex: Joe Biden might be president in 2021) so we basically just keep borrowing make-believe money to pay the interest on make-believe money we borrowed in the past.

Continually throwing “money” into the economy means eventual inflation. I mean major inflation. Sitting on cash right now is incredibly dangerous as I think we might be entering a phase where inflation rapidly wipes out the purchasing power of the U.S. dollar. Having $100,000 in the bank today means you have a lot of money but if in 5 years regular cars cost $200,000, suddenly your 100k isn’t worth so much. Money is only valuable insofar as you can exchange it for goods and service and how many goods/services a dollar is worth is highly variable. That is one half of the problem with a Universal Basic Income, giving people extra money for doing nothing means they will spend more money and that demand will cause prices to rise.

College tuition is a great example of this. With government grants and government subsidized and guaranteed loans, the available amount of money to pay for college is no longer what you could earn from summer jobs and how much your parents saved. Now you have unlimited funds to pay for college so you become less price conscious. People who might have gone to a state school or started at community college instead go to expensive out-of-state private schools and pay 2, 3 or 4 times as much per year. With increasing demand as dumber and dumber kids go to college and a loss of cost concern, colleges were able and quite willing to jack up tuition by double digits every single year until now a college degree in Urban Gender Justice Art Studies costs more than a nice house around here. Inflation.

When the checks arrive and people spend that money, most of them will still be struggling, mostly because they were already struggling before the China virus. What will happen next? We will get sob stories from the floor of the Congress and calls to “do more”, which means more checks. There is little chance that the wave of checks coming will be the last checks this year. Smart people will use those checks to pay down debt and invest in something other than mutual funds but most people will consume more stuff they don’t need.

Ironically enough, this fire-hose of cash and the inflation it brings will reward people in debt and punish those who save, a complete reversal of what is supposed to happen.

The coronavirus will kill a bunch of people and doom a lot of businesses. It will crush retirement dreams. It will change once again the expectation of people about what the role of government should be. It might mean Trump gets re-elected, who wants to put Joe Biden in charge of the recovery efforts? Trump’s approval numbers are pretty good right now and we are fast approaching the general election while the Democrat nomination is still unsettled and the ancient dementia patient who appears likely to win is staying at home giving cringe-inducing interviews.

What it will mostly do is accelerate the coming collapse. This will likely be remembered as a serious but not fatal crisis. What you do when things settle down will be the difference between surviving the Big One and not. Don’t waste any time.